- SAP FICO - Home

- SAP FI - Overview

- SAP FI - Submodules

- SAP FI - Company Basics

- SAP FI - Define Business Area

- SAP FI - Define Functional Area

- SAP FI - Define Credit Control

- SAP FI - General Ledger

- SAP FI - COA Group

- SAP FI - Retained Earnings Account

- SAP FI - G/L Account

- SAP FI - Block G/L Account

- SAP FI - Deleting G/L Accounts

- SAP FI - Financial Statement Version

- SAP FI - Journal Entry Posting

- SAP FI - Fiscal Year Variant

- SAP FI - Posting Period Variant

- SAP FI - Field Status Variant

- SAP FI - Field Status Group

- SAP FI - Define Posting Keys

- SAP FI - Define Document Type

- SAP FI - Document Number Ranges

- SAP FI - Post with Reference

- SAP FI - Hold a G/L Document Posting

- SAP FI - Park a G/L Document Posting

- SAP FI - G/L Reporting

- SAP FI - Accounts Receivable

- SAP FI - Customer Master Data

- SAP FI - Block a Customer

- SAP FI - Delete a Customer

- SAP FI - Customer Account Group

- SAP FI - One-Time Customer Master

- SAP FI - Post a Sales Invoice

- SAP FI - Document Reversal

- SAP FI - Sales Returns

- SAP FI - Post Incoming Payment

- SAP FI - Foreign Currency Invoice

- SAP FI - Incoming Partial Payments

- SAP FI - Reset AR Cleared Items

- SAP FI - Credit Control

- SAP FI - Accounts Payable

- SAP FI - Create a Vendor

- SAP FI - Create Vendor Acct Group

- SAP FI - Display Changed Fields

- SAP FI - Block a Vendor

- SAP FI - Delete a Vendor

- SAP FI - One-Time Vendor

- SAP FI - Post Purchase Invoice

- SAP FI - Purchases Returns

- Post Outgoing Vendor Payment

- SAP FI - Foreign Currency Invoice

- Withholding Tax in vendor invoice

- SAP FI - Outgoing Partial Payments

- SAP FI - Reset AP Cleared Items

- SAP FI - Automatic Payment Run

- SAP FI - Posting Rounding Differences

- SAP FI - Month End Closing

- SAP FI - Dunning

- SAP FI - Exchange Rates

- SAP FI - Tables in Module

- SAP FI - AR Invoice Processes

- SAP FI - AR Account Analysis

- SAP FI - AR Reporting

- SAP FI - AA Overview

- SAP FI - AA Asset Explorer

- SAP FI - Cash Management

- SAP CO - Overview

- SAP CO - Submodules

- SAP CO - Cost Center

- SAP CO - Create Cost Center

- SAP CO – Post to a Cost Center

- SAP CO - Internal Orders

- SAP CO - Settlement of IO

- SAP CO - Profit Center

- SAP CO - Postings to Profit Center

- Profit Center Standard Hierarchy

- Assigning Cost to Profit Centers

- Assigning Materials to Profit Center

- SAP CO - Tables in Module

- SAP CO - Product Costing

- SAP CO - Profitability Analysis

- SAP CO - Planning Methods

- SAP FI - Integration

SAP FI - Sales Returns

Sales Returns in SAP FI are used to manage full products that the customer has returned. These are used in consumer goods industry.

All returns are related to quality defects and not incorrect deliveries. The path that the returned merchandise takes often has to be tracked in detail. Returned items have to be sent for inspection.

Example − Once the analysis of the returned merchandise is complete, the vendor or manufacturer determines −

- The status of the merchandise and whether it can be reused.

- Whether the customer will be credited for the merchandise and the amount of credit.

The "Sales Returns" component gives you an overview of your physical warehouse stocks and the corresponding postings whenever you require.

How to post a Sales Return in SAP FI?

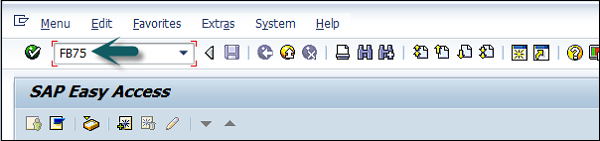

T-code FB75.

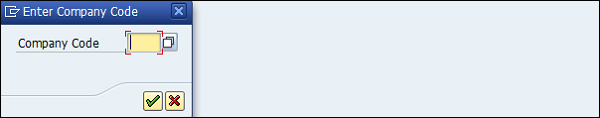

Enter Company Code, as shown in the following screenshot.

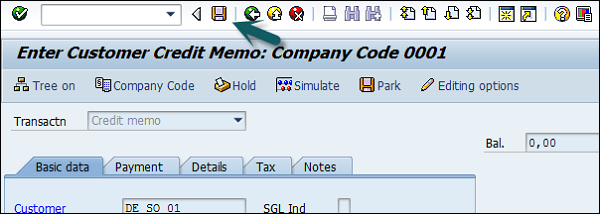

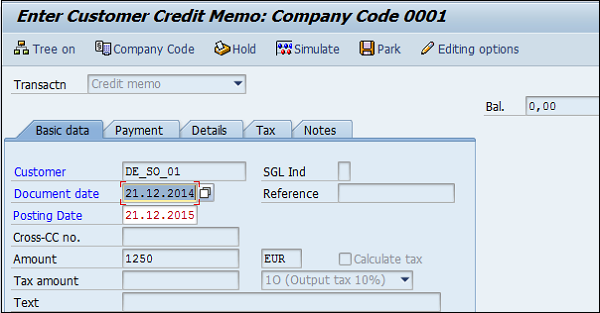

It will open a new window. Enter the following details −

- Enter the Customer ID of the customer to be issued the credit memo.

- Enter the Document Date.

- Enter the Amount to be credited.

- Enter the tax code used in the original invoice.

- Check the Calculate Tax checkbox.

Go to Item details section and enter the following data −

- Enter the Sales Revenue Account for the Original Invoice was posted.

- Enter the Amount to be debited and check the Tax code.

Once the required details are entered, click the Save button at the top. You will get a confirmation that Sales Return is posted in Company Code 0001.