- SAP FICO - Home

- SAP FI - Overview

- SAP FI - Submodules

- SAP FI - Company Basics

- SAP FI - Define Business Area

- SAP FI - Define Functional Area

- SAP FI - Define Credit Control

- SAP FI - General Ledger

- SAP FI - COA Group

- SAP FI - Retained Earnings Account

- SAP FI - G/L Account

- SAP FI - Block G/L Account

- SAP FI - Deleting G/L Accounts

- SAP FI - Financial Statement Version

- SAP FI - Journal Entry Posting

- SAP FI - Fiscal Year Variant

- SAP FI - Posting Period Variant

- SAP FI - Field Status Variant

- SAP FI - Field Status Group

- SAP FI - Define Posting Keys

- SAP FI - Define Document Type

- SAP FI - Document Number Ranges

- SAP FI - Post with Reference

- SAP FI - Hold a G/L Document Posting

- SAP FI - Park a G/L Document Posting

- SAP FI - G/L Reporting

- SAP FI - Accounts Receivable

- SAP FI - Customer Master Data

- SAP FI - Block a Customer

- SAP FI - Delete a Customer

- SAP FI - Customer Account Group

- SAP FI - One-Time Customer Master

- SAP FI - Post a Sales Invoice

- SAP FI - Document Reversal

- SAP FI - Sales Returns

- SAP FI - Post Incoming Payment

- SAP FI - Foreign Currency Invoice

- SAP FI - Incoming Partial Payments

- SAP FI - Reset AR Cleared Items

- SAP FI - Credit Control

- SAP FI - Accounts Payable

- SAP FI - Create a Vendor

- SAP FI - Create Vendor Acct Group

- SAP FI - Display Changed Fields

- SAP FI - Block a Vendor

- SAP FI - Delete a Vendor

- SAP FI - One-Time Vendor

- SAP FI - Post Purchase Invoice

- SAP FI - Purchases Returns

- Post Outgoing Vendor Payment

- SAP FI - Foreign Currency Invoice

- Withholding Tax in vendor invoice

- SAP FI - Outgoing Partial Payments

- SAP FI - Reset AP Cleared Items

- SAP FI - Automatic Payment Run

- SAP FI - Posting Rounding Differences

- SAP FI - Month End Closing

- SAP FI - Dunning

- SAP FI - Exchange Rates

- SAP FI - Tables in Module

- SAP FI - AR Invoice Processes

- SAP FI - AR Account Analysis

- SAP FI - AR Reporting

- SAP FI - AA Overview

- SAP FI - AA Asset Explorer

- SAP FI - Cash Management

- SAP CO - Overview

- SAP CO - Submodules

- SAP CO - Cost Center

- SAP CO - Create Cost Center

- SAP CO – Post to a Cost Center

- SAP CO - Internal Orders

- SAP CO - Settlement of IO

- SAP CO - Profit Center

- SAP CO - Postings to Profit Center

- Profit Center Standard Hierarchy

- Assigning Cost to Profit Centers

- Assigning Materials to Profit Center

- SAP CO - Tables in Module

- SAP CO - Product Costing

- SAP CO - Profitability Analysis

- SAP CO - Planning Methods

- SAP FI - Integration

- SAP FICO - Questions Answers

- SAP FICO - Quick Guide

- SAP FICO - Useful Resources

- SAP FICO - Discussion

SAP FI - Company Basics

A company is defined as the smallest unit for which financial statements can be created in accordance with commercial legal regulations.

In SAP FI, a company can comprise of multiple codes, however it acts as a single unit for which financial statements are available. All the company codes must use the same chart of accounts list and fiscal year, however each code can have a different local currency.

A chart of accounts list consists of all the chart of accounts that can be used and each code must have one chart of account.

A fiscal year normally consists of twelve months time period where company creates the financial statements.

SAP FI Create Company

Login to SAP FICO

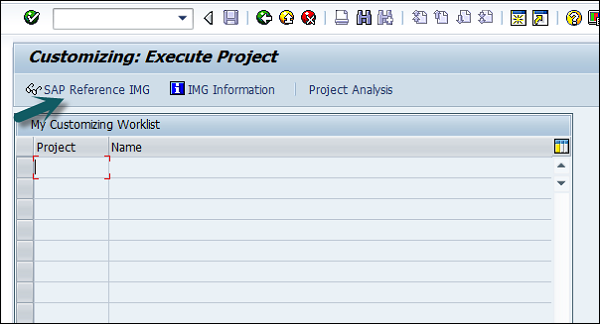

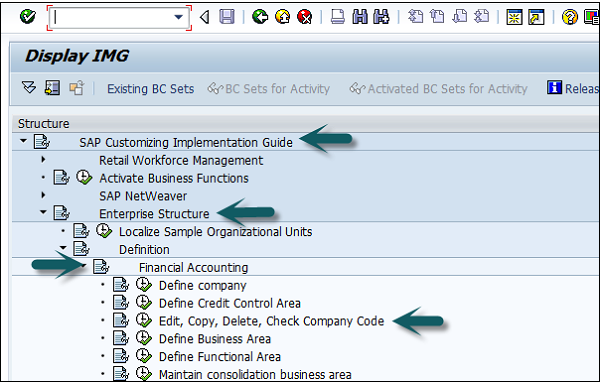

Use T-code SPRO → click on SAP Reference IMG → New window will open.

Expand SAP Customizing implementation guide → Enterprise Structure → Definition → Finance Accounting → Define Company → click on Execute (see the pointer in the screenshot).

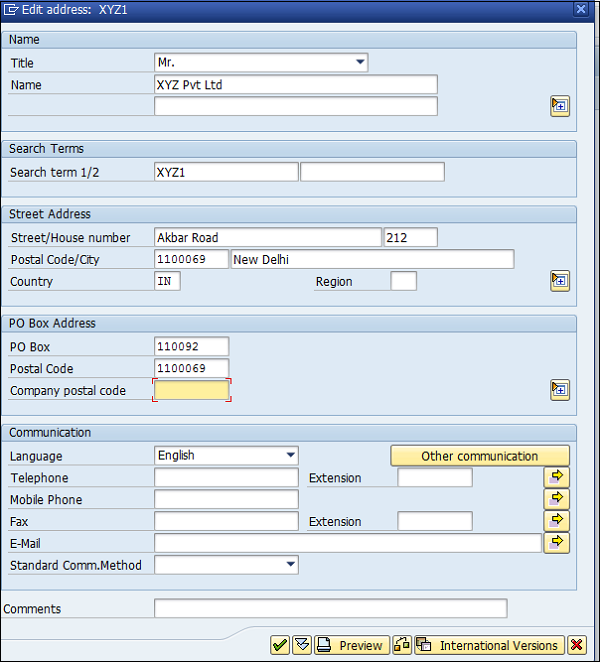

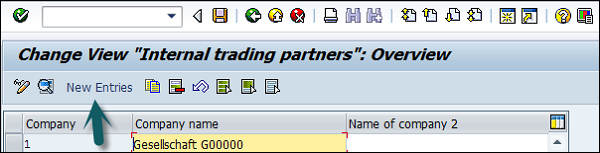

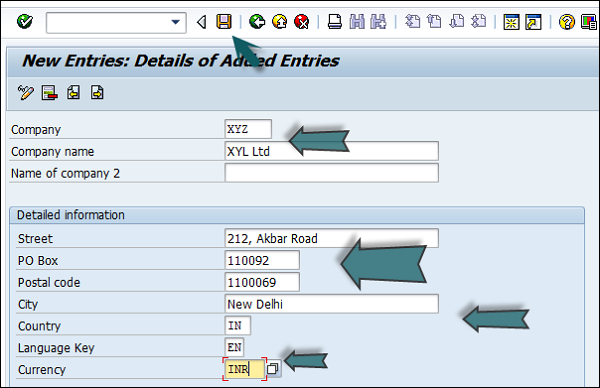

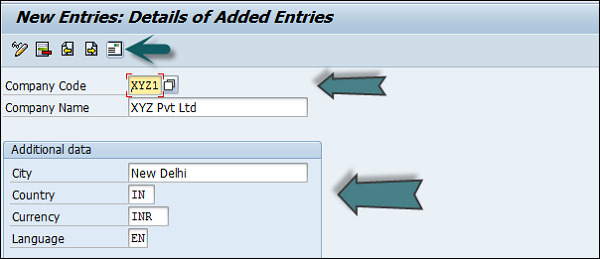

A new window will open → click on New Entries → New Entries: Details of added entry

You need to provide the following details to create a new company −

- Enter the company code to represents group of company.

- Enter the company name.

- Enter the full address-street, PO Box, postal code, city.

- Enter the Country.

- Enter the Language key.

- Enter the currency

The next step is to save the company details → CTRL+S or as shown in the above screenshot.

SAP FI Create Company Code

In SAP FI, a company can comprise of multiple codes, however it acts as a single unit for which financial statements are available. Company code is the smallest unit in an organization for which financial statements (profit-loss statement, etc.) can be generated.

Create, edit, delete a company code

Let us discuss how to create, edit, and delete a company code. Take a look at the following screenshot.

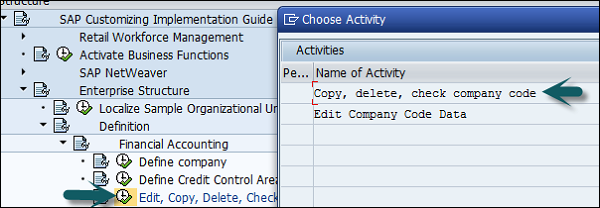

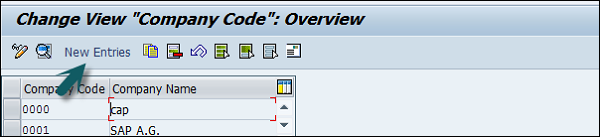

Expand Enterprise Structure as mentioned in the previous topic → Definition → Financial Accounting → Edit, Copy, Delete, check company code → Execute using click on the watch image → New window will open → You can create a new company code by selecting both the options.

Select Edit, Copy, Delete, and Check Company Code. It allows you to copy all the configurations and tables automatically.

If you select Edit company code, you will get the following window → click on New Entries and update the code details.

You can click on the Address button and update the following fields. Once the Address field is updated, click the Save button.