- SAP CRM – Home

- SAP CRM – Introduction

- SAP CRM – Architecture

- SAP CRM – Capabilities

- SAP CRM – Integration With SAP SD

- SAP CRM – GUI

- SAP CRM – WebClient UI

- SAP CRM – Web UI Configuration

- SAP CRM – Sales

- SAP CRM – Account Planning

- SAP CRM – Activity Management

- SAP CRM – Opportunity Management

- Quotation & Order Mngmt

- SAP CRM – Outline Agreements

- SAP CRM – Taxes

- SAP CRM – Marketing

- SAP CRM – Marketing Planning

- SAP CRM – Marketing Calendar

- SAP CRM – Campaign Management

- SAP CRM – Service

- SAP CRM – Service Request Mngmt

- SAP CRM – Service Contracts

- SAP CRM – Service Order Mngmt

- SAP CRM – Interaction Center

- SAP CRM – IC Profiles & Configuration

- SAP CRM – Product Master

- SAP CRM – Business Transactions

- SAP CRM – Pricing

- SAP CRM – Billing

- SAP CRM – Web Channel

SAP CRM - Taxes

To calculate tax in billing for CRM sales, Transaction Tax Engine (TTE) is used. TTE is used to determine and calculate tax on invoice statements and to calculate external tax. TTE is used in both CRM and SRM to calculate the tax.

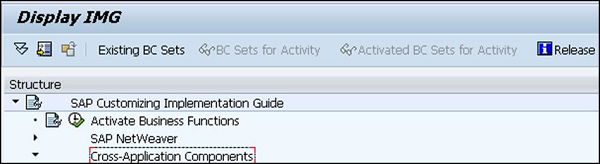

To implement Transaction Tax Engine, you have to make the setting in customizing for cross application components.

Go to SPRO → IMG → Cross-Application Components → Transaction Tax Engine → Tax Maintenance Settings → Tax Determination and Calculation → Define Tax Event Determination.

The key factor which is used to calculate the tax and for tax determination is a tax event. Applicable tax type, tax rate, locations and other factors are determined. It uses the decision tree to make tax determination and calculation more simple and transparent. You can also use simulation tool in TTE for tax determination and for testing customizing settings.

The Tax Calculation Process has the following steps −

TTE compiles an input document.

Tax event is derived by TTE from this input document.

Next is to derive the applicable tax calculation procedure and tax type from the tax event using TTE.

Then TTE sends the applicable tax calculation procedure to the Special Purpose Entity SPE for tax amount calculation.

TTE receives the tax calculation amount from the Special Purpose entity SPE.

The TTE then compiles the output document and returns the tax determination results like- tax type, tax calculation procedure, and tax calculation amount.

Rebate Processing in CRM Sales

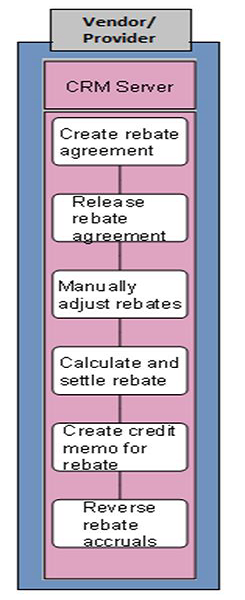

Rebate processing is used to process the special discounts that are paid to a customer occasionally. Rebate discounts are based on specific terms and conditions and are defined in rebate agreements. The goal of rebates is to build long-term customer relationships.

Rebate processing enables you to define rebate agreements and perform accounting for rebates given during the validity period of a rebate agreement.

You can access Rebate processing in CRM WebClient UI. Or few of these features can be accessed via SAP Easy Access menu.

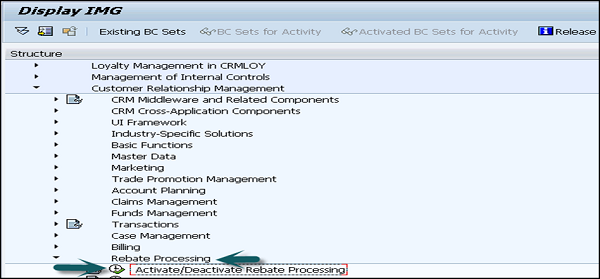

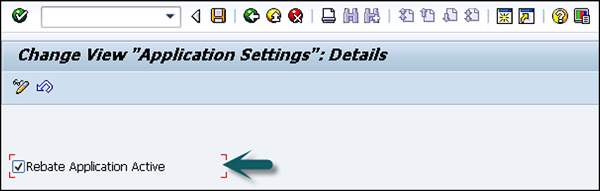

To activate the rebate processing, go to SPRO → IMG → Customer Relationship Management → Rebate Processing → Activate/Deactivate Rebate Processing.

The following rebate types can be used −

- Volume rebates

- Free goods rebates

Rebate programs can be defined in CRM Sales, and in CRM Marketing for Trade Promotions. Processing of rebates is triggered by billing documents in CRM Billing. CRM Rebate Processing is integrated with SAP ECC Financial Accounting for the posting of accruals.