- SAP Payroll - Home

- SAP Payroll - Introduction

- SAP Payroll - Off-Cycle Activities

- SAP Payroll - Infotypes

- SAP Payroll - Pay Scale Grouping

- SAP Payroll - Mid-Year Go Live

- SAP Payroll - Indirect Evaluation

- SAP Payroll - Gross Part

- SAP Payroll - Net Part

- SAP Payroll - Deductions

- SAP Payroll - Subsequent Activities

- SAP Payroll - Reports

- SAP Payroll - Reporting

- SAP Payroll - Rosters & Configuration

SAP Payroll - Mid-Year Go Live

Mid-Year Go Live data is used in countries where payroll is implemented in the middle of financial year. This is used for transferring legacy payroll data to the SAP System and also for creating payroll results from the transferred legacy data.

For Example − You can consider a case for India where income tax assessment year is performed from 1st April − 31st March. Now to implement SAP Payroll India in the middle of a Financial Year, there is a need to transfer payroll results for those periods of the financial year that lie before that period.

Pre-Go-Live

This is defined as a period for which the payroll results are available and need to be transferred to the SAP system.

Go-Live

This period is defined as the term when you process the first productive payroll run.

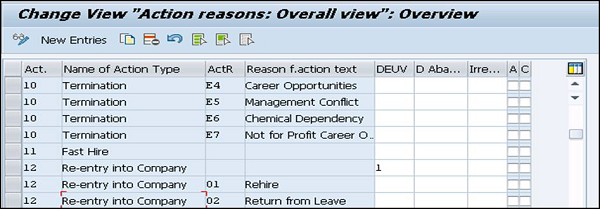

Rehiring

This is used to rehire an employee by using the same Personnel number as used in the time of last employment or within same financial year. The action type associated with this is Reentry into the company.

In case of rehiring an employee, if previous records are not delimited, you will have to delimit the previous records and there is a need to create new entries.

The following Infotype value needs to be updated for this action type −

Recurring Payments/Deductions (0014)

Organizational Assignment (0001)

Membership Fees (0057), Example: sports club, Union, etc.

Family Member/Dependents (0021)

Other Statutory Deductions (0588)

Long term reimbursements (0590)

Housing (0581), Example − HRA, Company owned, etc.

Running Payroll for Rehiring

While running the payroll for a rehired employee, payroll function checks the status of the rehired employees employment in the system. If the system is showing the present status as active preceded with withdrawn and active status within same Financial Year, this represents that the employee is rehired.

The status of an employees employment is maintained in the internal table COCD.

To check the previous payroll data for a rehired employee earning, deductions, and exemptions, this can be checked using the Results Table (RT) and the Cumulative Results Table (CRT).

Previous Employment Tax Details

The Payroll function INPET is used to process the previous employment tax details.

The following wage types are generated −

Wage Type /4V1 to /4V9 − This is created to maintain details of the employees employment in the other company in the same Financial Year.

Wage Type /4VA to /4Vg (From internal table 16) − This is created to maintain employees previous employment details in the same company in the same Financial Year.

The following components of the employees tax is calculated for a rehired employee −

Tax Exemptions on −

House Rent Allowance (HRA) (Metro or non-Metro)

Leave Travel Allowance (LTA)

Child Education Allowance or Tuition fee

Child Hostel Allowance (CHA)

The following perquisites are checked before calculating tax −

- Company Owned Accommodation

- Company Paid/Leased Accommodation

- Loans

The Payroll system also checks the below deductions for the employee −

- Deductions under section 80

- Section 89 relief

- Professional Tax

- Labor Welfare Fund (LWF), etc.

- Employee State Insurance (ESI)

- EPF Provident Fund and Pension Fund

A Split Payroll is run for the following periods First of the month to one day before the employee is rehired. And from the date of rehiring to the end of the month.

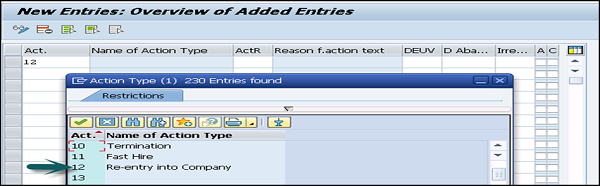

When an employee is rehired on any day other than the first, a split payroll is enabled. Go to SPRO → IMG → Payroll → Payroll India → Basic Settings → Enable Split Payroll Run.

In a new window, you will see the list of all split payroll in the system. To create a new entry, click on the New Entries tab at the top left hand side of the screen.

Enter the values: Act. 12 stands for re-entry into the company. In a similar way, you can select the other fields as well.

Once you enter all the details, click the save icon at the top left hand side of the screen.

An example of rehiring and payroll run −

An employee left a company on May 17, 2015 and was rehired on Nov 25, 2015. In this case, November payroll will be run twice.

For the period between Nov 1, 2015 and Nov 24, 2015.

For the period between Nov 25, 2015 to Nov 30, 2015.