Data Structure

Data Structure Networking

Networking RDBMS

RDBMS Operating System

Operating System Java

Java MS Excel

MS Excel iOS

iOS HTML

HTML CSS

CSS Android

Android Python

Python C Programming

C Programming C++

C++ C#

C# MongoDB

MongoDB MySQL

MySQL Javascript

Javascript PHP

PHP

- Selected Reading

- UPSC IAS Exams Notes

- Developer's Best Practices

- Questions and Answers

- Effective Resume Writing

- HR Interview Questions

- Computer Glossary

- Who is Who

Straight Line Method of Calculating Depreciation

Depreciation of Power Plant Equipment

The reduction in the value of the equipment and other property of the power station every year is known as depreciation. Therefore, a suitable amount, called depreciation charge, must be set aside annually so that by the time the life span of the power plant is over, the collected amount equals to the cost of the replacement of the power plant.

Straight Line Method of Depreciation

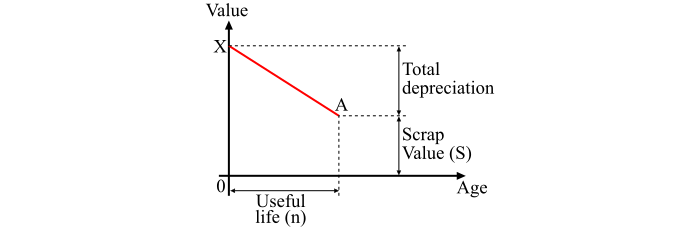

In the straight line method of calculating depreciation, a constant depreciation charge is made every year on the basis of total depreciation and the useful life of the equipment or other property. Therefore, the annual depreciation charge will be equal to the total depreciation divided by the useful life of the equipment and other property.

For example, if the initial cost of the equipment is Rs 150000 and its scrap value is Rs 15000 after a useful life of 20 years. Then, by the straight line method, the annual depreciation charge is given by,

$$\mathrm{Annual\: depreciation \: charge\mathrm{\, =\, }\frac{Total \: depreciation}{Useful \: life}\mathrm{\, =\, }\frac{150000-15000}{20}\mathrm{\, =\, }Rs\,6750 }$$

Hence, the general expression for the depreciation charge using the straight line method is given as −

$$\mathrm{Annual\: depreciation \: charge\mathrm{\, =\, }\mathit{\frac{X-S}{n}} }$$

Where,

- ? is the initial cost of the equipment or property

- ? is the scrap value after the useful life of the equipment

- ? is the useful life of equipment in years

The straight line method is very simple and easy to apply because in this method, the annual depreciation charge can be directly calculated from the total depreciation and useful life of the equipment.

The graphical representation of the straight line method is shown in the figure. From the graph it is clear that the initial value X of the equipment reduces uniformly, through depreciation to the scrap value S in the useful life of the equipment.

The depreciation curve (XA) follows a straight line path, indicating the constant annual depreciation charge. Although, this method has two defects: (i) the assumption of constant depreciation charge every year is not correct, (ii) it does not account for the interest which may be drawn during accumulation

Numerical Example (1)

A transformer costing Rs. 100000 has a useful life of 25 years. Determine the annual depreciation charge using straight line method, if the scrap value of the equipment is Rs. 12000.

Solution

Given data,

- Initial cost of transformer, ? = Rs 100000

- Scrap value of transformer, ? = Rs 12000

- Useful life of transformer, ? = 25 years

Then, using the straight line method, the annual depreciation value is,

$$\mathrm{Annual\: depreciation \: charge\mathrm{\, =\, }\mathit{\frac{X-S}{n}}\mathrm{\, =\, }\frac{100000-12000}{25}\mathrm{\, =\, }Rs\,3520 }$$

Numerical Example (2)

The alternator in a power station costs Rs 1050000 and has a scrap value of Rs 50000 at the end of 30 years. Determine the value of the equipment after 20 years by using straight line method.

Solution

Given data,

- Initial cost of alternator, ? = Rs 1050000

- Scrap value of alternator, ? = Rs 50000

- Useful life of alternator, ? = 30 years

Using straight line method,

$$\mathrm{Annual\: depreciation \: charge\mathrm{\, =\, }\mathit{\frac{X-S}{n}}\mathrm{\, =\, }\frac{1050000-50000}{30}\mathrm{\, =\, }Rs\, 33,333}$$

Thus, the value of alternator after 20 years is,

$$\mathrm{Value \: after\: 20 \: years \mathrm{\, =\, } \mathit{X}-\left ( Annual\: depreciation \times 20 \right )}$$

$$\mathrm{\therefore Value \: after\: 20 \: years \mathrm{\, =\, } 1050000-\left ( 33333 \times 20 \right )\mathrm{\, =\, }Rs. 383340}$$