Article Categories

- All Categories

-

Data Structure

Data Structure

-

Networking

Networking

-

RDBMS

RDBMS

-

Operating System

Operating System

-

Java

Java

-

MS Excel

MS Excel

-

iOS

iOS

-

HTML

HTML

-

CSS

CSS

-

Android

Android

-

Python

Python

-

C Programming

C Programming

-

C++

C++

-

C#

C#

-

MongoDB

MongoDB

-

MySQL

MySQL

-

Javascript

Javascript

-

PHP

PHP

Selected Reading

Explain about factoring in financial management.

Factoring is a financial arrangement between the company and financial institute, in which company get money in form of advance in return for receivables from financial institution. In this, company is called client and financial institution is called factor. Factoring agreements involves the factor, the client and a customer.

Functions of a factor are as follows −

- Maintain accounts.

- Providing advisory services.

- Providing short-term finance.

- Providing credit protection.

- Providing collection facilities.

Features of factoring are as follows −

- Clients credit is covered through advances.

- Cash advances.

- Collection services.

- Provide advice.

Steps involved in factoring are as follows −

- Customer places an order to seller.

- Agreement is made between the factor and seller.

- Sale contract is made and goods are delivered to the buyer.

- Copy of invoice is sent to factors and the factor prepares some percentage of invoice value.

- Monthly statements are sent to buyer by factor.

- If any unpaid services are there, follow up is initiated.

- Buyer settles invoice before credit period.

- Balance percentage (if any) is paid to the client by factor.

Some of the advantages of factoring are as follows −

- Better working capital management.

- Turnover stocks increases.

- Reduces the risk.

- Reduction in debts.

Limitation of factoring includes −

- High risk is involved.

- Uneconomical for small companies.

- Assessing the credit risk.

- Lack of professionals.

- Non-acceptance of change.

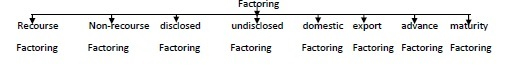

The types of factoring are given below −

Advertisements