- Appointments

- Awards

- Bills & Acts

- Books & Authors

- Committees

- Deaths

- Defence

- Economic

- Environment

- Banking and Finance

- Important Days

- International

- Miscellaneous

- National

- Persons in News

- Places in News

- Regional

- Reports

- Resignations & Retirements

- Science & Technology

- Sports

- September 2019 - Exams Resources

- Current Affairs - Quiz

- Current Affairs - Test

- Current Affairs - PDF

Current Affairs Sep 2019 - Banking & Finance

1 - IDBI Bank introduced repo-linked home and auto loans

IDBI Bank has introduced Repo linked home loan and car loan-Suvidha Plus Home Loan and Suvidha Plus Auto Loan effective from September 10.

RBI, on September 4, had mandated banks to link fresh retail loans to external benchmark. The three external benchmarks the RBI has proposed for linkage of new home and auto loans are its policy repo rate, the Government of Indias three-month and six-month treasury bill yields published by Financial Benchmarks India Private (FBIL), or any other benchmark market interest rate published by FBIL.

2 - SBI, Shanghai becomes first Indian bank to link up with China National Advance Payment System

The State Bank of India's (SBI) Shanghai branch became the first Indian Bank to connect to China's National Advance Payment System (CNAPS). The CNAPS provides real-time settlement services for all payments cleared in China.

The CNAPS was launched in 2008 by People's Bank of China (PBOC). SBI is the only Indian bank to have obtained the license to do business in local currency. The SBI had obtained the PBOC approval in December 2016 for implementation of the CNAPS and it was made live on July 8, 2019.

3 - RBI allowed Bank of China to offer regular banking services in India

The Reserve Bank of India (RBI) allowed Bank of China to offer regular banking services in the country. It has been included in the Second Schedule to the Reserve Bank of India Act. In another notification, 'Jana Small Finance Bank Limited' too has been included in the Second Schedule.

Further, the name of 'The Royal Bank of Scotland plc' has been changed to 'NatWest Markets Plc' in the Second Schedule while 'National Australia Bank' has ceased to be a banking company within the meaning of the Banking Regulation Act.

4 - Government launched updated Credit linked Capital Subsidy Scheme for MSMEs

The government launched the updated Credit linked Capital Subsidy Scheme (CLCSS) to allow micro, small and medium enterprises (MSMEs) access to capital. The government has approved an outlay of Rs 2,900 crore for the scheme in February 2019.

The CLCSS offers an upfront subsidy of 15 % on institutional credit up to Rs 1 crore for MSMEs sectors in the specified 51 sub-sectors. In the new updated scheme, there is an additional 10 % subsidy for Scheduled Castes (SCs) and Scheduled Tribes(ST) entrepreneurs while special provisions have been offered for 117 aspirational districts, hill states and the northeastern region in India.

5 - RBI Makes External Benchmark Based Interest Rate mandatory from October 1, 2019

Reserve bank of India mandated banks to link all new floating rate personal or retail loans and floating rate loans to MSMEs to an external benchmark to improve transmission of interest rate to be effective October 1, 2019. The banks are free to choose one of the several benchmarks and choose their spread over the benchmark rate.

At present, banks were pricing loans as per MCLR framework but report of the RBI constituted an Internal Study Group recommended that the transmission of policy rate changes under the current MCLR framework has not been satisfactory.

6 - India Post Payments Bank announced rollout of AEPs at the 1st Anniversary of its Business Operations

The Union Minister for Communications Shri Ravi Shankar announced the rollout of Aadhaar Enabled Payment System (AePS) Services by India Post Payments Bank (IPPB) for expanding access to financial services for millions of unbanked and underbanked customers. IPPB achieved the milestone of 1 Crore customers and exhorted them to achieve 5 crore target in next one year.

With the launch of AEPS services, IPPB has now become the single largest platform for providing interoperable banking services to the customers of any bank.

7 - RBI to come out with mobile app for visually challenged

The Reserve Bank of India will come out with a mobile application to help visually challenged people in identifying currency notes. At present, banknotes in the denominations of 10, 20, 50, 100, 200, 500 and 2,000 are in circulation, besides Re 1 notes issued by the Centre.

The proposed mobile app would be able to identify the denomination of notes of Mahatma Gandhi Series and Mahatma Gandhi (New) series by capturing the image of the notes placed in front of mobile camera.

8 - Finance Ministry introduced code of conduct and peer review for non-official directors of PSBs

The Finance Ministry has introduced a code of conduct and peer review for non-official directors of public sector banks (PSBs) to enhance governance in public sector banks (PSBs) through improved effectiveness of non-official directors (NODs).

Peer review of NODs has been stipulated upon completion of one year from the date of his/her nomination. The PSBs will now have to file performance report of the NODs to Finance Ministry. NODs are directors nominated by the government, as promoter, at PSBs.

9 - Government to recapitalise Public Sector Insurance companies

The government is going to infuse public sector insurance companies -- National Insurance, Oriental Insurance and United India Insurance with funds worth 12,000 crores to boost their capital base and meet regulatory norms.

The three Public Sector Undertakings (PSU) insurers have more than 200 insurance products with a total premium of Rs 41,461 crore and a market share of around 35 per cent as on March 31, 2017. The Budget had provisioned 70,000 crores for Public Sector Banks (PSB) recapitalisation and last week a 55,250-crore infusion was announced in several PSBs for regulatory and growth requirements.

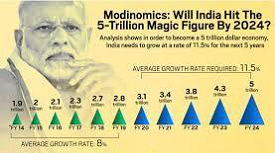

10 - NDA government takes key steps to make India 5 trillion economy

With an objective to make India a five trillion-dollar economy, the NDA government has undertaken several measures to boost the economy.

Cabinet committees set up to spur investment and create new employment opportunities in the country.

A high-powered Committee setup on structural reforms in the agriculture sector.

To boost the automobile sector, it has increased the allowable depreciation to 30% on all vehicles acquired from now till March 2020.

Customs duty is being exempted on certain parts of electric vehicles to further incentivise e-mobility.

70,000 crore rupees will be released to public sector banks.

11 - Centre to give support of Rs 8,500 crore to ECGC

The Central government will give support of 8,500 crore rupees to Export Credit Guarantee Corporation of India, ECGC, in the next five years. The interest rates will be 3.5%. ECGC has introduced a scheme called Niryat Rin Vikash Yojana - NIRVIK to enhance loan availability to exporters.

Under the new scheme NIRVIK, up to 90% of the principal amount and interest will be covered through insurance. It will cover both pre and post-shipment credit.

12 - Commerce Ministry raised Insurance cover for Banks up to 90% for Working Capital Loans

Union Minister of Commerce & Industry and Railways, Piyush Goyal informed about the details of the Export Credit Insurance Scheme (ECIS) in New Delhi. Ministry of Commerce & Industry has enhanced Insurance cover for Banks up to 90% for the working capital loans and moderation in premium incidence for the MSME sector. Enhanced cover will ensure that Foreign and Rupee export credit interest rates will be below 4% and 8% respectively for exporters.

The existing covers issued by Export Credit Guarantee Corporation of India (ECGC) will continue for the existing customer banks.

13 - MFIN, Sa-Dhan jointly launch Code for Responsible Lending for microfinance industry

Microfinance Institutions Network (MFIN) and Sa-Dhan along with FIDC (Finance Industry Development Council) have jointly launched the Code for Responsible Lending (CRL) for the micro credit industry. The CRL was launched at Sa-Dhans 15th Annual National Conference held in New Delhi.

Sa-Dhan is Reserve Bank of India (RBI) recognised self-regulatory organisation and industry association for the microfinance industry. A common CRL unveiled would bar more than three lenders offering loans to a single borrower and cap the size of total lending to Rs.1 lakh per borrower.

14 - RBI expands scope of Bharat Bill Payment System

The Reserve Bank of India has expanded the scope of the Bharat Bill Payment System (BBPS) by adding other categories of recurring payments through the portal like school fees, insurance premiums and municipal taxes.

Currently, the facility of payment of recurring bills through BBPS is available only in five segmentsdirect to home (DTH), electricity, gas, telecom and water. The system will provide multiple payment modes and instant confirmation of payment. BBPS functions under the aegis of National Payments Corporation of India (NPCI).

15 - Public Sector Banks to organise loan melas in 400 districts

Finance Minister Nirmala Sitharaman announced to organise loan melas or Shamiana meetings in 400 districts by Public Sector Banks, non-banking financial companies (NBFCs) and micro-finance institutions. The first will be held between October 3 and 7 in 200 districts, while the remaining 200 will be covered October 11 onwards, for consumers who may want a loan.

Each and every bank will be allotted a number of districts such as SBI is expected to hold the most in 50 districts and Syndicate Bank will operate in 25 districts.

16 - Airtel Payments Bank launched Bharosa savings account

Airtel Payments Bank launched Bharosa Savings Account, which has been designed to serve the unique needs of underbanked and unbanked customers. Bharosa Savings Account offers free Personal Accident Insurance cover worth Rupees Five Lakhs on maintaining a balance of just Rs 500 along with one debit transaction per month.

Customers will be also eligible for cashback - if they decide to receive government subsidies in their Bharosa Account or if they make cash deposits in it. Airtel Payments Bank was the first payments bank to launch operations in India.

17 - Digital Payment Abhiyan launched by DSCI, MeitY and Google India

Nasscoms Data Security Council of India (DSCI), electronics and IT ministry (MeitY) and Google India collaborated to launch nationwide awareness campaign Digital Payment Abhiyan to make people aware of digital frauds and adopt security and safety best practices.

DSCI has onboarded various digital payments ecosystem partners such as representation partners from banking, card networks as well as fin-tech segment. Campaign will educate people about the dos and donts for different payment channels including UPI, wallets, cards as well as netbanking and mobile banking.

18 - RBI puts Mumbai-based PMC Bank under directions

The Reserve Bank of India has placed the Punjab and Maharashtra Cooperative (PMC) Bank Limited, Mumbai, Maharashtra under Directions. According to the Directions, depositors will be allowed to withdraw a sum not exceeding 1,000 rupees of the total balance in every savings bank account or current account or any other deposit account, subject to conditions stipulated in the RBI Directions.

The bank will also not be able to grant or renew any loans and advances, make any investment, incur liability including borrowal of funds and acceptance of fresh deposits, without prior approval in writing from the Reserve Bank. The Directions shall remain in force for a period of six months from the close of business of the bank on 23rd September, 2019.