Data Structure

Data Structure Networking

Networking RDBMS

RDBMS Operating System

Operating System Java

Java MS Excel

MS Excel iOS

iOS HTML

HTML CSS

CSS Android

Android Python

Python C Programming

C Programming C++

C++ C#

C# MongoDB

MongoDB MySQL

MySQL Javascript

Javascript PHP

PHP

- Selected Reading

- UPSC IAS Exams Notes

- Developer's Best Practices

- Questions and Answers

- Effective Resume Writing

- HR Interview Questions

- Computer Glossary

- Who is Who

Why is it beneficial for companies in KSOP?

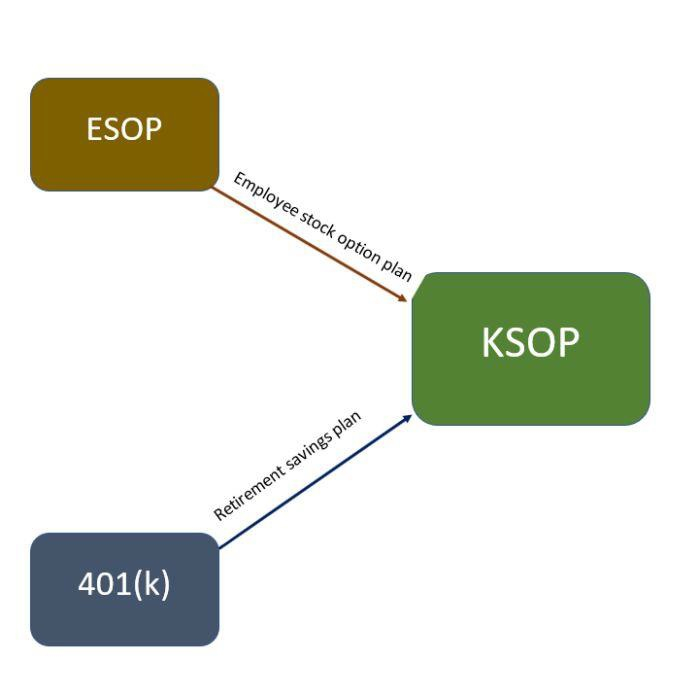

Kansas Stock Ownership Plans (KSOP) is a popular retirement plan that combines an employee’s stock ownership stock ownership plan with a 401(k) plan. The firm matches stock benefits for the employee based on their performance instead of cash. They provide double benefit for organizations and combine the offerings of ESOP and 401k retirement plans.

KSOP offers dual benefits of ESOP and 401(k) retirement plans.

What is KSOP?

As businesses continue to evolve, they have realized the benefits of combining two different strategies and this is where KSOP has offered a significant offering to them. The retirement plans are of two types −

a defined benefit package is a traditional pension plan funded by an employer.

a defined-contribution plan, where employers pay from their own assets, and receive tax benefits and are in complete control.

Defined benefit packages are more common than defined contribution plans. In addition to being a defined benefit plan, the KSOP retirement plan is also a fusion of two plans, which helps the organization to reduce expenses associated with administering two different retirement plans.

Key Points Briefly

Because the KSOP is a hybrid of employee stock ownership plans (ESOPs) and 401(k) plans, rather than a cash-based plan, the company may balance employee gifts with its own shares.

Employees are more likely to make a larger commitment to the success of a firm if the firm invests in their KSOPs.

The policy restricts company shares from being invested without distributing the risk among a variety of different assets.

How does KSOP Function?

As KSOP is a plan that combines ESOP and 401(k), it is of dual benefit for businesses than providing only a cash-based plans to their employee. The organizations will provide a valuation in their share depending on the post of the job, position of the executive and the value they offer to the company. There may be occasions that organization could offer a cash-based plan separately in addition to KSOP.

Employees could easily switch and use their policy if both have been provided to them. These reasons make it extremely beneficial both for the business as well as for employees who will be joining these corporations.

What are the advantages of KSOP?

KSOP retirement plan allows firms to give workers more benefits at a reduced cost to the firm than would otherwise be possible. When the tax savings realized by the ESOP are added to the labour compensation package, the effectiveness of the benefits program is increased. Employers may choose to include the saved cash into their 401(k) or other retirement plan as a matching gift.

The plan gives a combined benefits dual plans and the employees are able to appreciate the flexibility and spend as a result of this combination of factors. IN comparison to individual plans, this offers a robust solution that is extremely attractive for the employers and could potentially give them larger savings.

It makes the work of organizations faster and there is less administrative work as both plans of ESOP and 401(k) gets combined. The amount of documentation also get reduced for the backend administrative support staff and there will definitely be savings as firms wont have to pay additional expenditure for IRS.

What are the limitations of KSOP?

When compared to 401(k) retirement plans there is heightened risk associated with the KSOP plans to the employee portfolio. The traditional plans are safer as they have more diversification options and also gives the employees the option to chose multiple risk and reward profiles.

A KSOP plan is restricted only the company stock and it is subjected to a lot more volatility and giving very few options for the employees to choose from unlike other plans. The 401(k) plans provide the benefit to select from a wide array of different kind of assets and thus negating the risk factor as well.