Data Structure

Data Structure Networking

Networking RDBMS

RDBMS Operating System

Operating System Java

Java MS Excel

MS Excel iOS

iOS HTML

HTML CSS

CSS Android

Android Python

Python C Programming

C Programming C++

C++ C#

C# MongoDB

MongoDB MySQL

MySQL Javascript

Javascript PHP

PHP

- Selected Reading

- UPSC IAS Exams Notes

- Developer's Best Practices

- Questions and Answers

- Effective Resume Writing

- HR Interview Questions

- Computer Glossary

- Who is Who

What is a Working Capital Cycle?

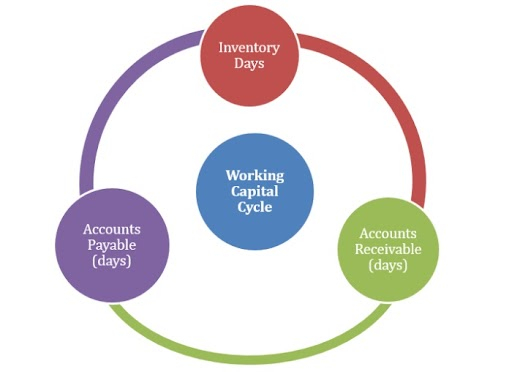

The Net Working Capital of a company is the difference between its current assets and current liabilities. We can define the Working Capital Cycle of a company as the duration of time it takes to converts its net working capital into cash.

A longer Working Capital Cycle denotes that the company is blocking its capital in working capital without earning any returns on it. Hence, most companies try to reduce the working capital cycle by disposing the inventory quickly and collecting the receivables as early as possible. Sometimes, companies stretch their Accounts Payable (pay their bills slowly) in order to optimize the cash flow.

Steps in the Working Capital Cycle

For most companies, the working capital cycle includes the following three stages ?

Inventory Days - How long does it take to sell the inventory?

Receivable Days - The time it takes to receive payments from the clients.

Payable Days - The time it takes to pay the suppliers.

Based on the above steps, the formula to calculate working capital cycle (days) is as follows ?

WCC = Inventory Days + Receivable Days - Payable Days

For example, if a company takes 60 days to clear the inventory, receives the payments in 30 days, and clears the suppliers' payments in 45 days, then the working capital cycle of the company is ?

WCC = 60 + 30 - 45 = 45 days

It implies that the company blocks its working capital for 45 days before receiving the full payment.

Positive vs. Negative Working Capital Cycle

In the above example, the company has a positive working capital cycle, which is the normal scenario in most businesses. However, there may be instances when a company receives the payments faster than it pays off its dues.

In our example, suppose the same company receives its payments in 15 days but pays its suppliers in 90 days, then the company will enjoy a negative working capital cycle.

WCC = 60 + 15 - 90 = -15 days

It means the company has cash on its books for an additional 15 days which is an advantage.

A positive working capital cycle of 15 days implies that the company remains out of cash for 15 days and it has to be funded by a bank for those 15 days. This will in turn reduce the profitability of the company. Hence, the shorter the working capital cycle, the better it is for the company. In that sense, a negative working capital cycle can be considered as a big bonus for the company.