Article Categories

- All Categories

-

Data Structure

Data Structure

-

Networking

Networking

-

RDBMS

RDBMS

-

Operating System

Operating System

-

Java

Java

-

MS Excel

MS Excel

-

iOS

iOS

-

HTML

HTML

-

CSS

CSS

-

Android

Android

-

Python

Python

-

C Programming

C Programming

-

C++

C++

-

C#

C#

-

MongoDB

MongoDB

-

MySQL

MySQL

-

Javascript

Javascript

-

PHP

PHP

What are liabilities in accounting?

According to International Financial Reporting standards (IFRS), Liabilities are present obligations of the enterprises arising from past events, the settlement of which is expected to result in an outflow from the enterprises of resources embodying economic benefits.

In simple words, it is amount owned by the company to the creditors.

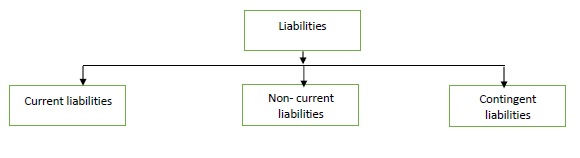

Classification of liabilities is as follows −

Current liabilities − Payment period is less than one year. It is also called as short term liability.

Examples − Accounts payable, interest payable, income tax payables, bills payable, bank account overdrafts, accrued expenses, short term loans.

Non – current liabilities − Payment period is more than one year.

Examples − Bonds payable, long term notes payable, deferred tax payable, mortgage payable, capital leases.

Contingent liabilities − Occurs due to specific reasons.

Examples − Law suits, warranty, pending investigations.