- Indian Economy Tutorial

- Indian Economy - Home

- Indian Economy - Introduction

- Indian Economy - Planning

- Indian Economy - Sectors

- Indian Economy - Demography

- Indian Economy - People As Resource

- Indian Economy - National Income

- Indian Economy - Poverty

- Indian Economy - Food Security

- Indian Economy - Employment

- Indian Economy - Infrastructure

- Indian Economy - Rural Development

- Indian Economy - Money & Banking

- Economy - Government Budget

- Indian Economy - Consumer Rights

- Indian Economy - Reforms

- Indian Economy - Open

- Indian Economy - Micro Economics

- Indian Economy - Macro Economics

- Economy - Sustainable Development

- Indian Economy Useful Resources

- Indian Economy - Online Quiz

- Indian Economy - Online Test

- Indian Economy - Quick Guide

- Indian Economy- Useful Resources

- Indian Economy - Discussion

Indian Economy - Government Budget

Introduction

In a mixed economy, Government plays an important role.

On certain things, the government has an exclusive right, such as national defence, roads, government administration, etc. (these are known as public goods).

Government’s allocation function relates to the provision of public goods and services by agencies of the government.

Through its tax and expenditure policy, government attempts to bring about a distribution of personal income of households in a manner that is considered just and fair. It taxes the rich and designs schemes which benefits the poor.

Annual Financial Statement

According to the Article 112 of the Indian Constitution, the Government at the centre needs to present annual financial statement before the Parliament. It is a statement of estimated receipts and expenditures of the Government of India in respect of each financial year, which runs from 1 April to 31 March.

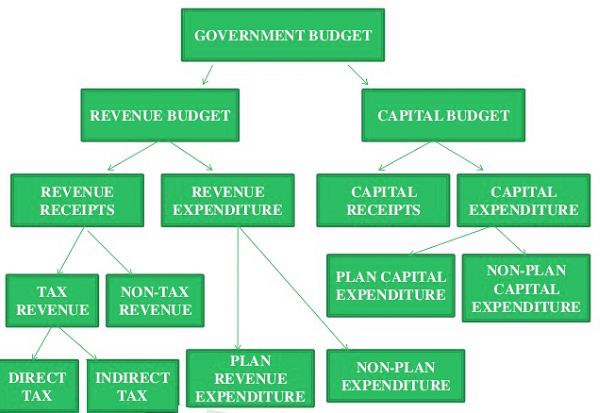

The Annual Financial Statement is also the main Budget document and is commonly referred to as the Budget Statement. The different types of budgets included in this are as follows −

- Revenue Budget

- Capital Budget

Revenue Budget

The Revenue Budget illustrates the −

The Revenue (current) receipts (of the government) and

The Revenue expenditure (that can be met from these receipts).

Revenue Receipts

Revenue receipts are receipts of the government which are non-redeemable, i.e., they cannot be reclaimed from the government.

Revenue receipts are categorized as −

Tax Revenue.

Non-tax Revenues.

Tax revenues consist of the proceeds of the taxes and other duties levied by the central government.

Tax revenues are further classified into direct taxes (levied directly from the individuals as income tax) and indirect taxes (levied on goods and products within the country).

Corporation tax contributes the largest share in revenue receipts, followed by income tax.

Non-tax revenue of the central government largely comprises of −

Interest receipts on account of loans by the central government.

Dividends and profits on investments made by the government.

Fees and other receipts for services rendered by the government.

Cash grants-in-aid from foreign countries and international organizations.

Revenue Expenditure

On the other hand, Revenue Expenditure largely includes −

The expenses incurred for the normal functioning of the government departments and various services.

Interest payments on debt incurred by the government.

Grants those are given to the state governments and other parties.

Budget documents classify total expenditure into plan and non-plan expenditure.

The plan revenue expenditure includes the central Plans (the Five-Year Plans) and central assistance for State and Union Territory plans.

Non-plan expenditure includes interest payments, defence services, subsidies, salaries, and pensions.

Subsidies are important policy instruments, destined to promote welfare in the society.

Capital Budget

The Capital Budget is an account of the assets as well as liabilities of the central government; it takes into consideration changes in capital.

The capital account is further categorized as follows −

- Capital Receipts

- Capital Expenditure (of the government).

Capital Receipts

Capital Receipts include all those receipts of the government, which create liability or reduce financial assets.

Main items of capital account are loans raised by the government from −

The public, which is known as market borrowings.

From the Reserve Bank and commercial banks.

Other financial institutions through the sale of treasury bills.

Loans received from the foreign governments and the international organizations.

Recoveries of the loans granted by the central government.

Some other items of capital account are −

Small savings – such as Post-Office Savings Accounts, National Savings Certificates, etc.)

Provident funds and net receipts obtained from the sale of shares in Public Sector Undertakings (PSUs.

Capital Expenditure

Capital Expenditure includes the expenditures of the government, which result in the creation of physical or financial assets or reduction in financial liabilities.

Examples of capital expenditure are as follows −

Acquisition of land, building, machinery, equipment, investment in shares, and

Loans and advances by the central government to the governments of state and union territory, PSUs and other parties.

Budget Deficit

When a government spends more than it receives by the way of revenue, it is known as the budget deficit.

The difference between revenue expenditure and revenue receipts is known as the revenue deficit.

The difference between the government’s total expenditure and its total receipts excluding borrowing is known as the fiscal deficit.

The growth of revenue deficit as a percentage of fiscal deficit points to a deterioration in the quality of government expenditure involving lower capital formation.

Government deficit can be reduced by an increase in taxes or/and reduction in expenditure.

Public debt is burdensome if it reduces the future growth in terms of output.